🚨 Bitcoin Update: Steady Rebound & Fresh Catalysts

Here’s the latest on Bitcoin — what’s driving it, what to watch — all in one place:

📈 What’s Happening

- Bitcoin is trading around $106,000, after recently dipping near $99,000 and then rebounding. (The Economic Times)

- The rebound comes amid growing optimism: the looming end of the United States Senate-government shutdown in the US appears to be triggering risk-on sentiment, which is helping Bitcoin and other major cryptos. (Yahoo Finance)

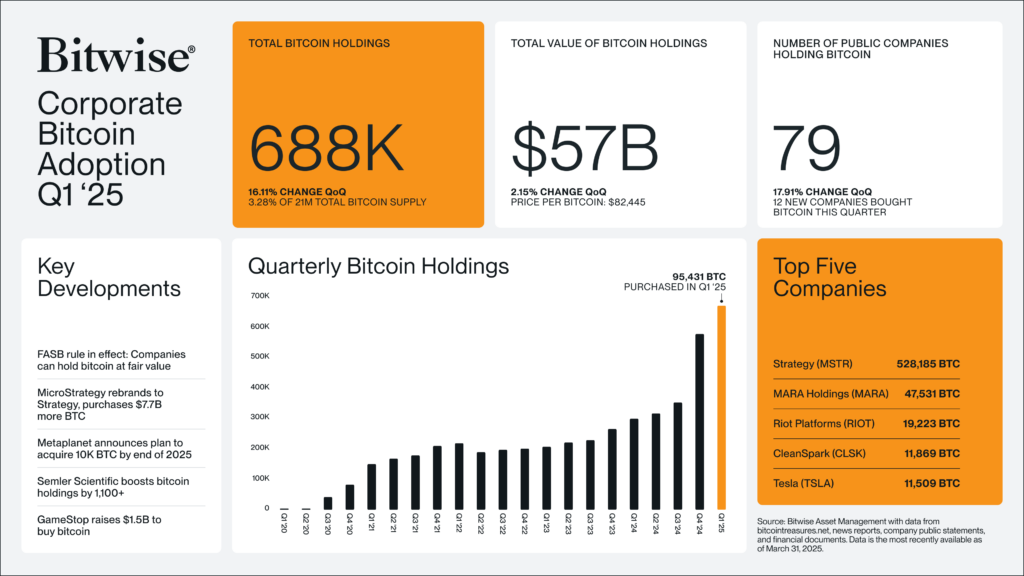

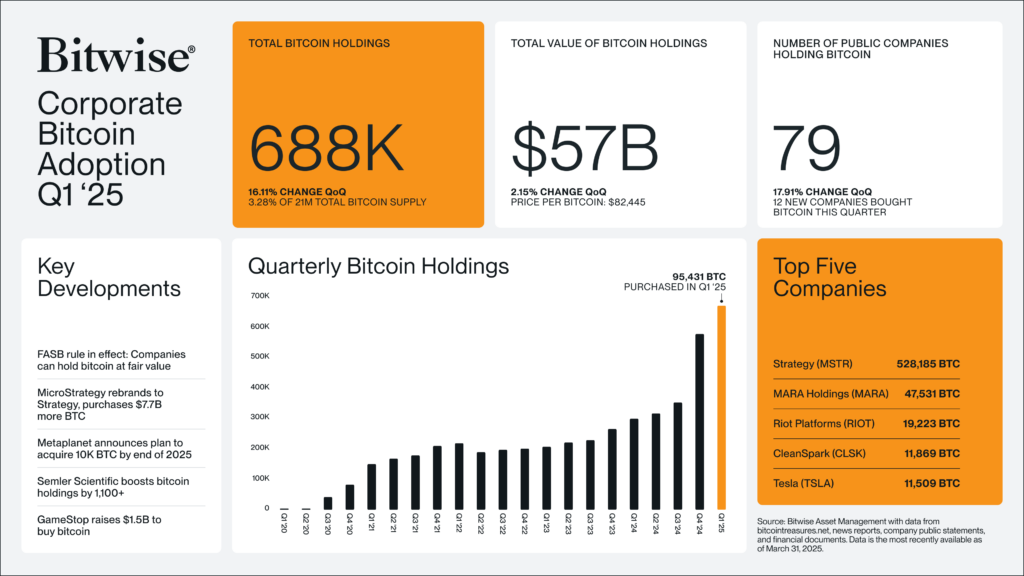

- Institutional players continue to show interest — accumulation by major firms is a signal that some view Bitcoin not just as a speculative asset, but as a strategic store of value. (CryptoSlate)

- On the downside: there’s notable hedging in the options market (lots of put options near $80K–$90K strikes), meaning some traders are expecting further downside risk too. (CoinDesk)

🧭 What to Keep an Eye On

- Support zone around $99,000: This appears to have held recently, making it a key level to watch. (The Economic Times)

- Resistance / catalyst levels: If sentiment continues improving (eg. via US fiscal relief or regulatory clarity), Bitcoin could test higher levels again; but if the macro backdrop worsens, the hedgers may be right.

- Institutional flows: These are tougher to see in real time, but accumulation by large firms can change the landscape. The long-term narrative matters.

- Macro & regulatory environment: Bitcoin’s movements are increasingly tied to broader issues — government spending, regulation, institutional endorsement. The end of the US shutdown is one such trigger.

✅ Why This Matters

- For investors and observers, Bitcoin holding above its recent support after a drop shows resilience.

- The narrative is shifting: from purely speculative to strategic reserve asset (at least in some quarters).

- Yet, volatility remains high. Hedging activity suggests caution is still widespread.

Bottom line: Bitcoin’s rebound to ~$106K is a positive sign, but the market remains in wait-and-see mode. Those watching closely should monitor support/resistance levels, institutional behaviour, and macro developments.

Would you like a deeper dive into one of the catalysts (e.g., institutional accumulation, options market, or the US shutdown)?

🚨 Bitcoin Update: Steady Rebound & Fresh Catalysts

Here’s the latest on Bitcoin — what’s driving it, what to watch — all in one place:

📈 What’s Happening

- Bitcoin is trading around $106,000, after recently dipping near $99,000 and then rebounding.

- The rebound comes amid growing optimism: the looming end of the United States Senate-government shutdown in the US appears to be triggering risk-on sentiment, which is helping Bitcoin and other major cryptos. (Yahoo Finance)

- Institutional players continue to show interest — accumulation by major firms is a signal that some view Bitcoin not just as a speculative asset, but as a strategic store of value.

- On the downside: there’s notable hedging in the options market (lots of put options near $80K–$90K strikes), meaning some traders are expecting further downside risk too. (CryptoWave)

🧭 What to Keep an Eye On

- Support zone around $99,000: This appears to have held recently, making it a key level to watch.

- Resistance / catalyst levels: If sentiment continues improving (eg. via US fiscal relief or regulatory clarity), Bitcoin could test higher levels again; but if the macro backdrop worsens, the hedgers may be right.

- Institutional flows: These are tougher to see in real time, but accumulation by large firms can change the landscape. The long-term narrative matters.

- Macro & regulatory environment: Bitcoin’s movements are increasingly tied to broader issues — government spending, regulation, institutional endorsement. The end of the US shutdown is one such trigger.

✅ Why This Matters

- For investors and observers, Bitcoin holding above its recent support after a drop shows resilience.

- The narrative is shifting: from purely speculative to strategic reserve asset (at least in some quarters).

- Yet, volatility remains high. Hedging activity suggests caution is still widespread.

Bottom line: Bitcoin’s rebound to ~$106K is a positive sign, but the market remains in wait-and-see mode. Those watching closely should monitor support/resistance levels, institutional behaviour, and macro developments.

Would you like a deeper dive into one of the catalysts (e.g., institutional accumulation, options market, or the US shutdown)?

No Comments